Why Sports Betting Websites needs an Instant EFT option

South Africans are a sports-loving nation and, with greater mobile penetration and over a year of...

Why Sports Betting Websites needs an Instant EFT option

South Africans are a sports-loving nation and, with greater mobile penetration and over a year of...

Nine ways to slash e-commerce cart abandonment

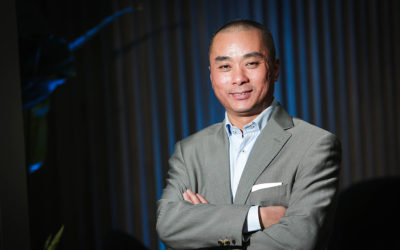

Kyle Rozendo, CTO at SID Instant EFT puts forward nine simple ways to make sweeping changes to e-commerce website performance.

Maximise the holiday e-commerce cheer and avoid a fraud hangover

This year’s sudden spike in online shopping on Black Friday showed the true potential of e-commerce in South Africa. But it also showed that local merchants may not be prepared for sudden spikes in e-commerce trade which will continue into the festive season. By offering SID Instant EFT as a payment method, local merchants can significantly cut down on fraud and improve customer service.

Chargebacks: How they can affect your online business?

All e-commerce businesses face the risk of losses due to chargebacks and fraud. This article outlines 7 simple ways in which you can protect your online store.

Secure EFT Drives Confidence in E-Commerce

“E-commerce is growing by leaps and bounds, but each business, whether large or small depends not only on great products and good delivery, but also on the trust of the customer to utilise online payment methods so the transaction can actually take place. If this trust is not there, they may as well close shop,” says Kyle Rozendo, CTO at SID Instant EFT.

Should South Africa be writing its own PSD2 regulations?

Europe’s Payment Services Directive 2 (PSD2) is expected to come into force in January 2018. With some banking industry commentators referring to it as the biggest development in banking history, one has to wonder why South Africa has not already begun to follow suit.

Choosing the right payment vendor can help developers deliver

The South African e-commerce web development landscape is highly competitive with shrinking margins and developers highly sensitive to delays. Working with a payment vendor which understands the needs of developers as well as merchants can make all the difference.

Secure EFT – still the best way to get South Africans trading online

While online retail still only accounts for 1% of retail revenue in South Africa, the growth rates of more than 20% year-on-year since 2000 speak volumes about the need for every business to seriously plan for an online presence.

SID 2 Sails Through Its Launch

Today is exactly 100 days since the launch of...

Top South African Payment Gateways Support the Launch of SID 2.0

Leading South African Payment Gateways have...

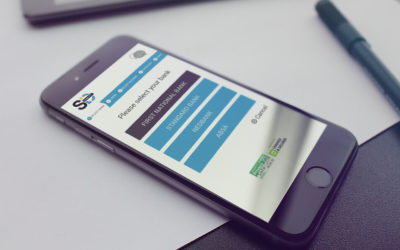

Quick & Easy Online Payments on Any Device with SID Secure EFT

https://youtu.be/X3wNcUe8a38 SID Secure EFT has...

eRetail Sales to Reach $1.7 Trillion This Year

New data from Juniper Research has revealed that...

SID Secure EFT Remains One of SA’s Favourite Online Payment Alternatives to Credit Card

An ever increasing number of South African...

Omni-Channel Retailing: The Future of Commerce

A few years ago, industry wisdom held that...

Customer Support Now Available 365 Days a Year

In a commitment to providing partners and...

Secure Online and Mobile Payment Solutions for South African Entrepreneurs

Setcom Payment Solutions has been a leading...