Europe’s Payment Services Directive 2 (PSD2) is expected to come into force in January 2018. With some banking industry commentators referring to it as the biggest development in banking history, one has to wonder why South Africa has not already begun to follow suit.

PSD2 was drafted to further standardise, integrate and improve efficiencies between EU states as well as stimulate competition in payments across the Eurozone. Effective regulations also add to the protection of consumers as well as the obvious benefits of more options, cost savings and increased service.

Although a large chunk of the attention has been focused on the open banking APIs and the standards surrounding this requirement, the new ways that consumers can pay for purchases should be giving local bankers pause for thought.

European online shoppers wishing to pay via their bank account, rather than the traditional card payments, will certainly benefit. The Payment Initiation Service Provider (a ‘PISP’ under the new PSD2 terminology) will allow online merchants to ask for permission to securely access your bank account, with a simple yes or no response as to whether you have funds. This means that multiple intermediaries are removed from the payment lifecycle – resulting in cost savings as well as fewer potential points of failure.

In fact, a recent (pre-Brexit) UK study by Accenture suggests that online merchants will pass these savings on to consumers and estimated the cost savings to be around £1.45bn of card transaction revenues between 2017 and 2020.

One of the most compelling aspects of PSD2 is that it would create an environment for new players to register as payment institutions. These new entities, although well regulated, have nowhere near the restrictive requirements of a commercial bank since they neither offer loans, nor credit facilities. They will greatly increase the choice for consumers and the added competition will drive innovation and further cost cutting benefits.

We could use a little of that

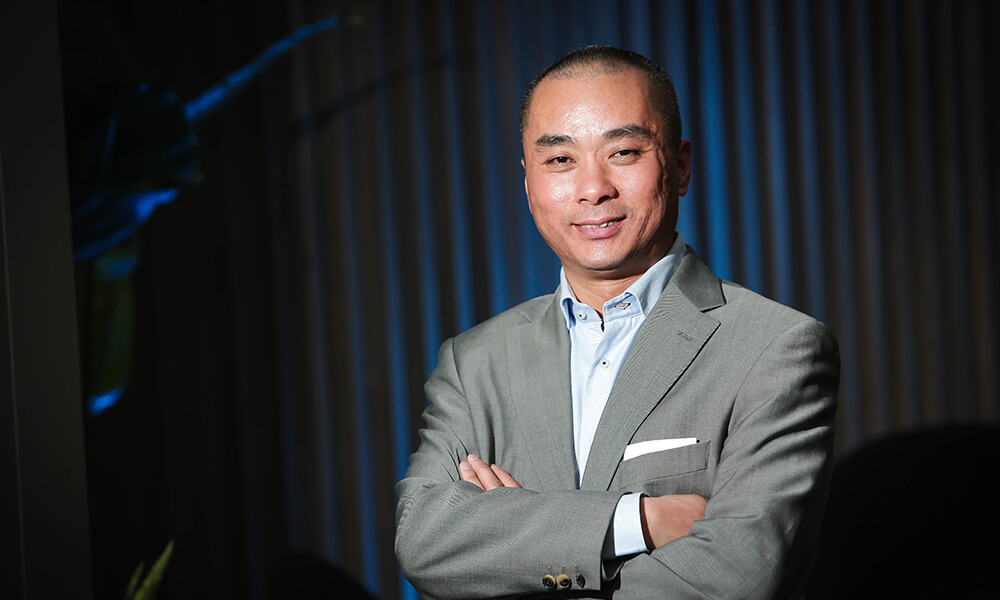

Although South Africa has been recognised for its excellent innovation and benchmarking technology developments, we cannot claim to have the most competitive banking environment.

Moving towards a PSD2-type of regulatory environment would fling open the doors for more players to register as payment institutions.

Not only will this bring additional competition to the market, but it would also make a substantial difference to the e-commerce landscape.

While online retail still only accounts for a small portion of retail revenue in South Africa, growth rates of more than 20% year-on-year for the past 16 years clearly demonstrate the potential of local e-commerce.

The best way to further boost these numbers – and the economy in general – is to find ways to onboard new merchants as quickly as possible.

It currently takes around two weeks for a local company to get trading online. The compliance, registration for merchant bank accounts, and volumes of paperwork, puts South Africa well behind our global contemporaries. In the US and Europe, for example, you can sign up for a merchant account online and be approved almost immediately.

A revised regulatory environment would bring all the benefits coming to the EU e-commerce merchants. Fast, simple registration to get online and trading, lower costs, more competition and better choice – all of which will drive innovation and further improve services and prices.

Light-touch regulations don’t mean risk

Taking a page out of the EU book would also benefit consumers. Of course, they will score with lower prices, but the PSD2 regulations actually go a long way towards better oversight – something which is nowhere near as robust in the current local payment landscape.

While it’s hugely difficult to meet the requirements for a banking license in South Africa, payment service providers and aggregators face very little regulation.

Unlike the EU Payment Initiation Service Providers, local players are not compelled to keep their operating capital separate to that of their customer’s fund.

Any institution taking payments in the EU needs prove they have enough capital to sustain business operations and the regulators audit these companies every year. Should the volume of business increase, the capital requirements are increased to ensure these capital reserve safeguards are met.

This shifting capital reserve has been formulated so that the entry requirement is fairly low, allowing for easy (but safe) entry into the payments market. However, by keeping revenues separate and implementing yearly audits, the chances of clients being exposed to the risk of non-payment are minimal.

In short, there may still be some debate around interoperability standards, but the new PSP2 regulations will significantly drive competition and innovation into the payments space. It will have a profound economic impact, particularly for online merchants. For a country which prides itself on its progressive banking and payments industry, it seems curious that we have not yet moved in the same direction.